Microsoft Excel is a spreadsheet application

invented and developed by Microsoft Corporation.

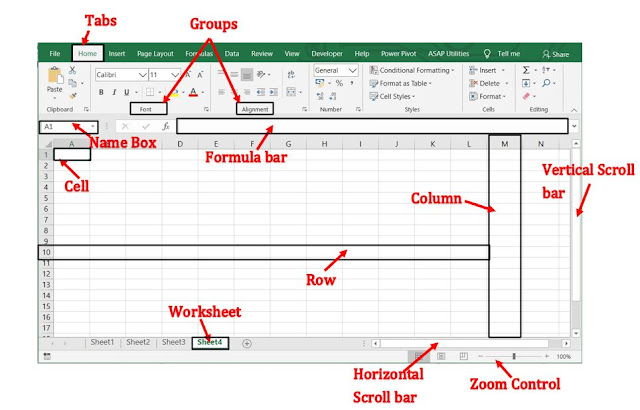

Spreadsheet of Excel is a combination

of Columns and Rows. Here column shall be show in alphabetic order like A, B, C

………so on and row is in numeric order like 1, 2, 3, …………….. so on.

Total column and Total Row

Column 16,384 (Name of last column is XFD)

Row 10,48,576

How to launch Excel

1. Click on the Start Button.

2. In the Search Program and Files box

type Excel.

3. Click on Excel 2013 from the Program

results.

4. The Microsoft Excel 2013 program will

open

OR

1. Press the Windows key on the keyboard.

2. Type Excel.

3. Click on Excel 2013 under the Apps

results.

OR

1.. Press Window key and R(Run)

2. Type excel in dialogue box

3. Press Enter

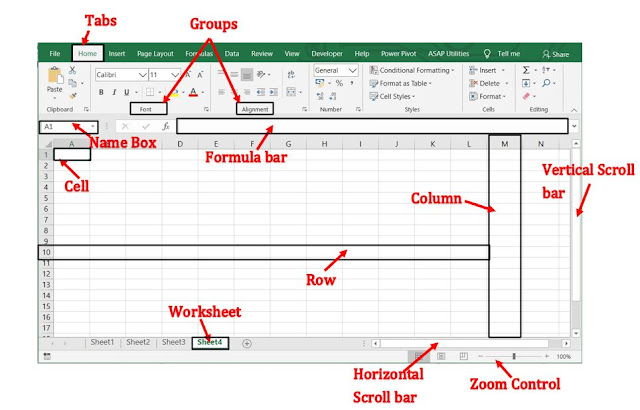

Excel Overview

The Excel Interface given in the image given

below:

Understanding

of cells

if you all see in Spreadsheet thousands

of rectangles are there to see and these rectangles are occurring of

intersection of column and row. Those rectangles are called as cells. Every

cell has own name and name should be based on column and row.

Cell

Every cell has its own name, or cell address, in light of

its segment and line. In this model, the chose cell crosses segment C and

column 5, so the cell address is C5. The cell address will likewise show up in

the Name box. Note that a cell's segment and line headings are featured when the

cell is chosen.

Mouse Cursors are available in excel for different

purposes.

The

Five most important shapes are as follows:

| Using for Selection a cell or more than one

cells. |

| The Auto fill handle. Used for copying formula

or extending a data series.

|

| To select cells on the worksheet. Selects whole

row/column when positioned on the number/letter heading label. |

| At borders of column headings. Drag to widen a

column. |

| At borders of row letters. Drag to increase height

of row. |

Excel Home Tab

The Excel Home Tab is utilized to perform regular orders,

for example, Bold, underline, Copy, and Paste. It is additionally used to apply

formatting to cells in a worksheet.

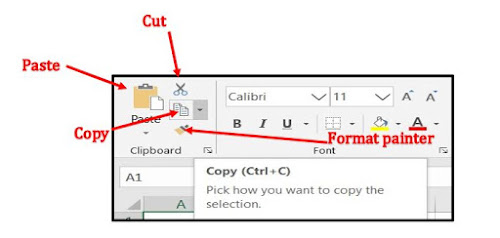

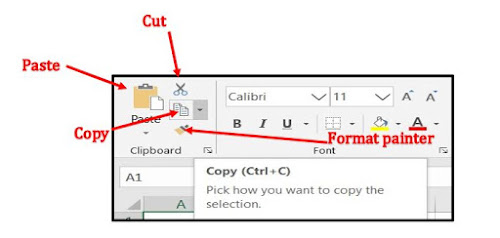

Clipboard Group

1.

Paste: To insert data that

has been placed on the clipboard into a worksheet cell, click this button.

2.

Cut: This button is used

to remove data from a worksheet cell and place it on the clipboard. Once the

data has been placed on the clipboard, it can be inserted into another cell in

the same worksheet or into a different worksheet.

3.

Copy : To copy data from a cell in a worksheet so

that it can be placed into another area of the worksheet, click this button.

The data that is copied is placed on the clipboard.

4.

Format Painter: Click

this button to apply formatting from one cell in a worksheet to another cell or

range of cells in the same worksheet. Clicking the button once will apply the

formatting to only one other cell or range. Double-clicking makes it possible

to apply the formatting to more than one cell or range of cells.

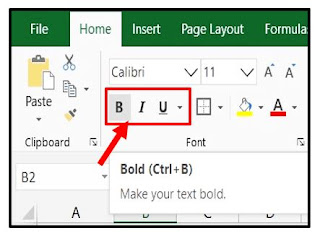

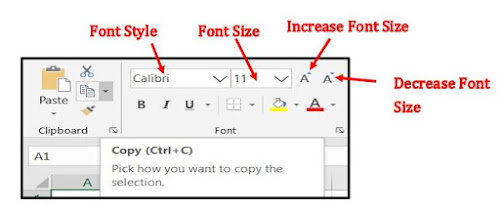

Font Group

Font Type: This button is used

to change the style of the font within a cell or a range of cells in a

worksheet. A list of different font styles will appear. Move the mouse pointer

over the style to see a Live Preview.

Font Size: To change the size

of the font in a cell or range of cells in a worksheet, click this button. Move

the mouse pointer over each of the sizes to see a Live Preview. A list of

different font sizes will

appear. Click the desired size

to select it.

Increase Font Size: This

button is used to increase the font size within a cell or range of cells. Each

time the button is clicked, the size of the font increases by one or two

points.

Decrease Font Size: Click this button to

decrease the size of the font by one or two point increments. Each time the

button is clicked, the size of the font will decrease one or two points.

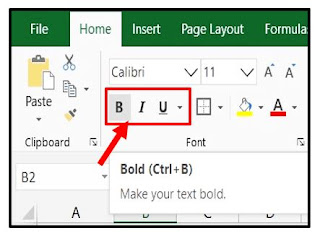

To

use the Bold, Italic, and Underline commands

1. Select

the cell(s) you wish to modify.

2. Click the Bold (B), Italic (I), or Underline (U) command on the Home tab. In our example, we'll make the selected cells bold.

3. The selected style will be

applied to the text.

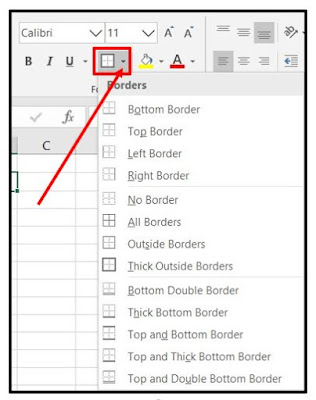

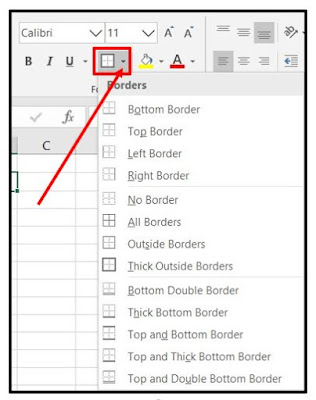

Border

Style

Allow

you to create clear and defined boundaries for different sections of your

worksheet.

To add a border

1. Select the cell(s) you wish to modify.

2. Click the drop-down arrow next to the Borders

command on the Home tab. The Borders drop-down menu will appear.

3. Select the border style you want to use.

4. The selected border style will appear.

Cell

borders and fill colors

TIP: You can draw borders and

change the line style and color of borders with the Draw Borders tools at the

bottom of the Borders drop-down menu

1. Select

the cell(s) you wish to modify.

2. Click

the drop-down arrow next to the Fill Color command on the Home tab. The Fill

Color menu will appear.

3. Select the fill color you want to use. A live preview of the new fill color

will appear as you hover the mouse over different options. In our example,

we'll choose Light Green.

4. The selected fill color will appear in the selected cells.

1. Select

the cell(s) you wish to modify.

2. lick

the drop-down arrow next to the Font Color command on the Home tab. The Color

menu will appear.

3. Select

the desired font color. A live preview of the new font color will appear as you

hover the mouse over different options.

4.

The text will change to the selected font

color.

By default, any text entered into your worksheet will be aligned

to the bottom-left of a cell. Any numbers will be aligned to the bottom-right

of a cell. Changing the alignment of your cell content allows you to choose how

the content is displayed in any cell, which can make your cell content easier

to read.

To change horizontal text alignment

1. Select the cell(s) you

wish to modify.

2. Select one of the three horizontal alignment commands

on the Home tab. In our example, we'll choose Center Align.

3. The text will realign.

To change

vertical text alignment

1. Select the cell(s) you wish to

modify.

2. Select one of the three vertical alignment commands on

the Home tab. In our example, we'll

choose Middle Align.

3. The text will realign.

Wrap Text

Wrap text by Excel in the event that

you need to show long content on various lines in a current cell. Wrap text

naturally or enter a manual line break.

Ø Take

an example, Type a long text in cell A1

Ø Select

Cell A1 and go to Home Tab>>Alignment Group>> click on Wrap Text

Merge and Center

This option merge selected cells into one cell.

There is marksheet below and

we need a heading above of data with

see as screen given below:

Ø Select

Cell A1 and go to Home Tab>>Alignment Group>> click on Merge &

Center.

Style Group

Conditional formatting

Conditional formatting permits you to consequently apply

arranging, for example, Colors, Icon and Data bars—to at least one cells

dependent on the cell esteem. To do this, you'll have to make a Conditional

formatting rule.

For Example: if we want to the highlight the value more

than 30,000 in Total column of salary sheet.

Step 1: Select the range you want to apply the

rule.

Step 2:

Click to Conditional formatting option >> Highlight

Cell Rules>> Greater than

Step 3: put the value in dialogue box and see

the RESULT:

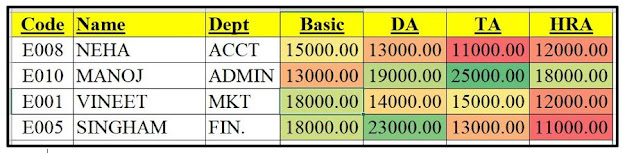

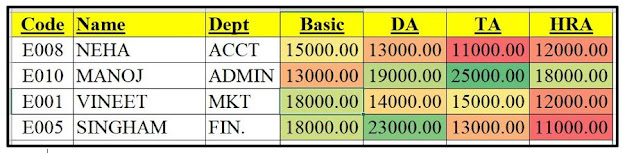

Let’s take another example: we want to highlight more

than 18,000 in all salary sheet data.

Follow same step as earlier example:

1. Select data from Basic to HRA column.

2. Follow same step to conditional formatting and highlight greater than rule:

In Conditional Formatting several option to represent

data in another format

· Data

Bar: Data bar like horizontal bar in each cell and rule apply according to cell

value in descending order/largest to smallest value.

See the image given below:

STEP:

Click to Conditional formatting

option >> Data bar

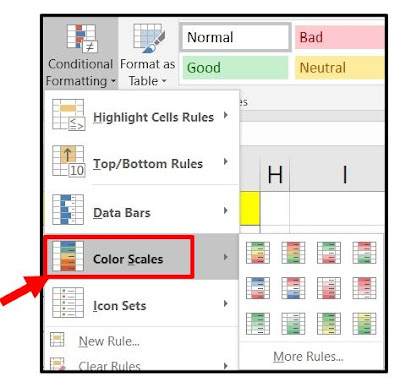

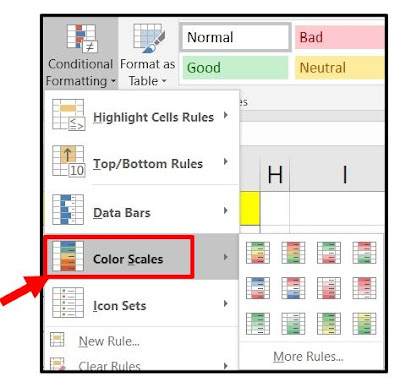

Color

Scale: Color

Scales change the color of each cell based on its

value. Each color scale

uses a two- or three-color gradient. For

example, in

the Green-Yellow-Red color scale, the highest values are

green,the average values are yellow, and the lowest values

are red.

STEP: Click to Conditional formatting option >>

Color scale

· Icon

Set: Specific or dynamic icon set on based on cell value.

STEP: Click to Conditional

formatting option >> Icon Set

If we want to remove any conditional

formatting so follow the step given below:

Select the area and Go To Conditional Formatting >>

Clear Rules >> Clear Rules from Selective Cells/ Clear Rules from Entire Sheet.

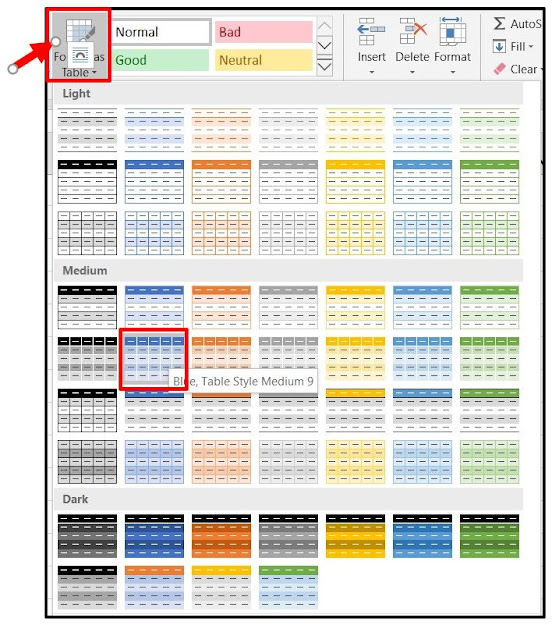

Format as Table

When you've entered data into a worksheet, you might need

to organize your information as a table. Much the same as ordinary arranging,

tables can improve the look and feel of your exercise manual, yet they'll

likewise assist with sorting out your substance and make your information

simpler to utilize. Exceed expectations incorporates a few instruments and

predefined table styles, permitting you to make tables rapidly and without any

problem.

Let’s go and see a normal data apply with format as table

with the help of picture:

Step 1: we have to select all data or put the

mouse cursor in the any one cell of data.

Step 2: Go to Format as Table>> select any style as

per the choice.

RESULT:

Cell styles

Rather than formatting cells manually, you can use

Excel's predesigned cell styles. Cell styles are a quick way to include

professional formatting for different parts of your workbook, such as titles

and headers.

To apply a cell style

1. Select the cell(s) you

wish to modify.

2. Click the Cell Styles command on the Home tab, then

choose the desired style from the drop-down menu.

3. The selected cell style will appear.

Cell Group

In this article, I am demonstrating how to

Insert-Delete-Format cells in Excel worksheets. Presently through to home tab

in Excel worksheets, you have a Group of orders which named Cell. The cell

Group contains a few orders and alternatives which are discussing the cell.

Inside every cell, we can do a ton of figuring, and every phone is significant

for our assignment. Presently there are three choices which are the most

significant, presently I will give you some data about these three choices the

show the uses.

Insert: Here you can become known about inserting a

cell, sheet rows, sheet columns, and Insert another sheet.

Delete: if

you have any useless cell, rows, columns, and worksheet you can delete it

easily

Format: Cell

design contains a few choices which can assist you with changing the size of

your cells. Hide and Unhide the cells, arrange sheets, and Protection.

Cell Size: – In this option we can change the height of rows and width of the columns, and also you can set a Autofit Row Height.

Visibility: – Here you can hide and unhide your cells, rows, columns, and sheets.

Organize Sheets: – Now you can rename the sheet as per your need and move or copy your sheet. And if you want to change tab color, so you can change too.

Auto sum: On the off chance that you have to sum a row or

column of numbers, let Excel figure it out for you. Select a cell close to the

numbers you need to total, click AutoSum on the Home tab, press Enter, and

you're finished. Shortcut keys of AutoSum is (“Alt”+”=”).

Fill: You can use

the Fill command to fill a formula into a Selective range of cells. You

can do the following:

1.

Select the cell with the formula and the range of cells you want to

fill.

2. Click Home > Fill,

and choose either Down, Right, Up, or Left as per your need

of direction.

shortcut keys:

a. Down Drag:

Ctrl+D

b. Right Drag:

Ctrl+R

Series: The Excel Fill Series tool is like having

a bundle of usage. It can help with one of the most common tasks we do in

Excel, which is to create a serial numbers like 1,2,3,….. so on and 1,3,5,…… so

on and also date fill. Fill Series option can easily handle them all.

for an example: create a series from 1 to

20 put 1 into any of cell and select that cell

Go to > home tab> editing

group>fill> series

Follow the step as given image.

Result:

If u want to fill series in odd and even

number series you have to set step value as per your need.

Like if you want to odd number like

1,3,5…………..

So, you have to write 1 in any cell and

select of it and follow same step as above but you have to taken step value 2

for odd number and as same for even number series.

Clear:

If

you want clear all data or clear formatting of data and some others also

available of clear option.

Go to > home tab>editing group>

clear

Sort & filter:

Sort: if you want to sort your data in A to Z or vice

versa and Numbers data in smallest to largest or vice versa

So, you can use sort option for that.

Go to>home tab>editing group> Sort & filter

You can see in image of option of A to Z and Z to A.

If you want to select option from Smallest to Largest or

vice versa you can select the range of numbers data. It will be shown as

smallest to largest or vice versa automatically.

Filter: you can easily filter your

large number of data in very easy option that

is filter

Go to > home tab>editing group> Sort &

filter

Let’s see usage of this option with an example:

We have some number of data given below:

Click on filter button and click on product filter

button:

Result:

Find & Select:

Find: When working with a large number of data in Excel,

it can be difficult and time consuming to locate specific information. You can

easily search using the Find feature.

Go to > home tab > editing group> Find &

Select

Let’s take an example:

Click on find option and type manoj to find.

Result:

Cursor

of mouse Automatically go to cell where Manoj name available.

Replace

Let’s take a same example as above for replace options:

Click on Replace option and type Manoj in find and type

Saroj in replace option.

Go To:

If you want to go any specific cells in entire worksheet

Use go to option for that

Go to > Home Tab > Editing > go to

Step 1

Click on go to and type cell name where you want to go.

0 coment:

Please do not post any spam link.